Multiple Choice

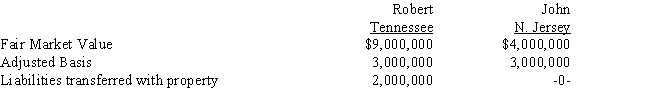

Robert trades an office building located in Tennessee to John for an apartment complex located in New Jersey.Details of the two properties:

In addition,John pays Robert $3,000,000 cash as part of this transaction.What is the gain (loss) recognized by Robert in this transaction and what is his basis in the New Jersey property?

Gain Recognized Adjusted Basis

A) $6,000,000 $4,000,000

B) $5,000,000 $3,000,000

C) $3,000,000 $2,000,000

D) $5,000,000 $4,000,000

E) Some other amounts

Correct Answer:

Verified

Correct Answer:

Verified

Q3: Which of the following exchanges of property

Q31: Grant exchanges an old pizza oven from

Q40: Ed and Elise got married during the

Q53: The general mechanism used to defer gains

Q63: Discuss the concepts underlying the determination of

Q79: Which of the following qualify as a

Q86: Which of the following qualify as a

Q96: If related parties complete a qualified like-kind

Q116: Mavis is a schoolteacher with an annual

Q117: A flood destroys Franklin's manufacturing facility. The