Multiple Choice

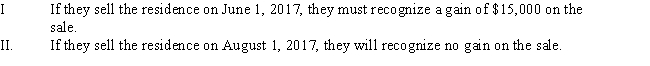

Charlotte purchases a residence for $105,000 on April 13,2004.On July 1,2015,she marries Howard and they use Charlotte's house as their principal residence.If they sell their home for $390,000,incurring $20,000 of selling expenses and purchase another residence costing $350,000.Which of the following statements is/are correct concerning the sale of their personal residence?

A) Only statement I is correct.

B) Only statement II is correct.

C) Both statements are correct.

D) Neither statement is correct.

Correct Answer:

Verified

Correct Answer:

Verified

Q3: Which of the following exchanges of property

Q11: Simon exchanged his Mustang for Michael's Econovan

Q31: Grant exchanges an old pizza oven from

Q38: A flood destroys Owen's building that cost

Q39: The mechanism for effecting a deferral in

Q40: Ed and Elise got married during the

Q53: The general mechanism used to defer gains

Q78: Sarah exchanges investment real estate with Russell.

Q83: Which of the following is/are correct concerning

Q117: A flood destroys Franklin's manufacturing facility. The