Essay

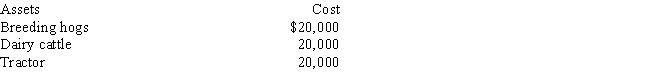

Determine the MACRS cost recovery deductions for 2017 and 2018 on the following assets that were purchased for use in a farming business on July 15,2017.The taxpayer does not wish to use the Section 179 election.

a.Breeding hogs depreciation:

Total 2017 Breeding hogs Cost Recovery Deduction (show your calculations)

Total 2018 Breeding hogs Cost Recovery Deduction (show your calculations)

b.Dairy cattle depreciation:

Total 2017 Dairy Cattle Cost Recovery Deduction (show your calculations)

Total 2018 Dairy Cattle Cost Recovery Deduction (show your calculations)

c.Tractor depreciation:

Total 2017 Tractor Cost Recovery Deduction (show your calculations)

Total 2018 Tractor Cost Recovery Deduction (show your calculations)

Correct Answer:

Verified

Total 2017 Breeding hogs Cost Recove...

Total 2017 Breeding hogs Cost Recove...View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Correct Answer:

Verified

View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Q7: Under current law, taxpayers must use regular

Q18: Match each statement with the correct term

Q19: Which of the following assets would not

Q47: Why might a taxpayer elect to depreciate

Q54: Davis,Inc. ,a motorcycle wheel manufacturer,purchased a new

Q55: Which of the following would not be

Q58: Nonresidential commercial realty placed in service on

Q59: Wu Copy Shop purchases a new copy

Q65: Which of the following would be allowed

Q89: Under the computation of the alternative minimum