Multiple Choice

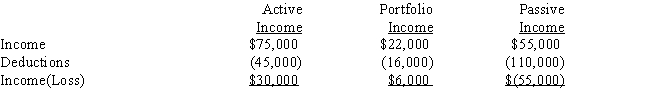

If a taxpayer has the following for the current year:

I.If the taxpayer is a regular corporation,taxable income from the three activities is a loss of $19,000.

II.If the taxpayer is an individual and the passive income is related to a rental real estate activity in which the taxpayer is an active participant,taxable income is $11,000.

A) Only statement I is correct.

B) Only statement II is correct.

C) Both statements are correct.

D) Neither statement is correct.

Correct Answer:

Verified

Correct Answer:

Verified

Q24: Sullivan, a pilot for Northern Airlines, has

Q34: John discovers that termites have destroyed the

Q39: Ronald is exploring whether to open a

Q51: The wash sale provisions apply to which

Q53: Barry owns all of the stock of

Q56: A taxpayer has the following income (losses)for

Q57: If a corporation incurs a net operating

Q62: Ford's automobile that he uses 100% for

Q108: Dwight owns an apartment complex that has

Q118: Match each statement with the correct term