Multiple Choice

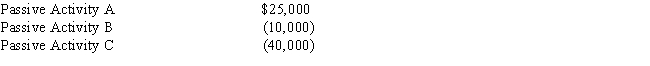

Loren owns three passive activities that had the following results for the current year:

If none of the passive activities are rental real estate activities,what is the amount of suspended loss attributable to Activity C?

A) $- 0 -

B) $18,750

C) $20,000

D) $25,000

E) $40,000

Correct Answer:

Verified

Correct Answer:

Verified

Related Questions

Q3: Gomez, a self-employed consultant, is involved in

Q52: During the current year, Schmidt Corporation has

Q77: Judy and Larry are married and their

Q79: Hamlet,a calendar year taxpayer,owns 1,000 shares of

Q82: Perry owns all of the stock of

Q86: The Ottomans own a winter cabin in

Q87: Pedro owns a 50% interest in a

Q100: Natalie is the owner of an apartment

Q107: Darien owns a passive activity that has

Q129: Any corporate capital loss not used in