Multiple Choice

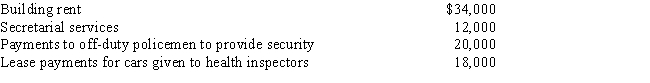

Chelsea operates an illegal gambling enterprise out of her restaurant.Considering only the following expenses,what amount can Chelsea deduct?

A) $- 0 -

B) $46,000

C) $66,000

D) $72,000

E) $84,000

Correct Answer:

Verified

Correct Answer:

Verified

Related Questions

Q16: Match each statement with the correct term

Q18: Match each statement with the correct term

Q45: If someone provides a taxpayer with either

Q61: Match each statement with the correct term

Q74: An ordinary expense<br>I.is an expense commonly incurred

Q76: Match each statement with the correct term

Q90: Christy purchases $1,000-worth of supplies from a

Q92: Amy borrowed $25,000 for her business from

Q136: Which of the following is/are currently deductible

Q144: In the current year, Paul acquires a