Essay

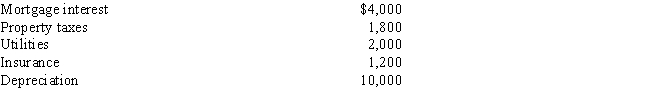

Cornelius owns a condominium in Orlando.During the year,Cornelius uses the condo a total of 25 days.The condo is also rented to vacationers for a total of 75 days and generates rental income of $9,000.Cornelius incurs the following expenses:

Determine Cornelius's deduction related to the condominium.Indicate the amount of each expense that can be deducted and how it would be deducted.

Correct Answer:

Verified

The rental is a vacation home because Co...View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Correct Answer:

Verified

View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Q10: Match the proper deduction method with the

Q13: Pedro owns 5 rental properties. He contracts

Q37: Which of the following factors absolutely must

Q68: For its financial accounting records Addison Company

Q82: Explain the rationale for disallowing the deduction

Q83: Match each statement with the correct term

Q86: For a taxpayer to be engaged in

Q125: Michelle is a bank president and a

Q134: Income tax accounting methods and financial accounting

Q147: Andy lives in New York and rents