Essay

Wilson owns a condominium in Gatlinburg,Tennessee.During the current year,she incurs the following expenses before allocation related to the property:

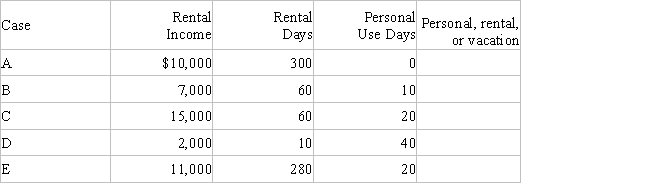

a.For each of the following scenarios indicate whether Wilson would treat the condominium for income tax purposes as personal use property,a rental or a vacation home.

b.Consider Case C.Determine Wilson's deductions related to the condominium.Indicate the amount of each expense that can be deducted and how it would be deducted.

Correct Answer:

Verified

Wilson can deduct $15,000 in allocated r...View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Correct Answer:

Verified

View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Q14: An ordinary expense<br>I.is normal, common, and accepted

Q46: Match the following statements.<br>-Organization costs<br>A)For the corporate

Q60: Ona is a professional musician. She prepared

Q64: Match the proper deduction method with the

Q65: Michael operates an illegal cock fighting business.

Q97: Match the proper deduction method with the

Q116: During the current year, Paul came down

Q151: Match each statement with the correct term

Q162: Kim owns and operates a restaurant on

Q163: Angela is an accrual basis taxpayer. On