Essay

Hu Corporation

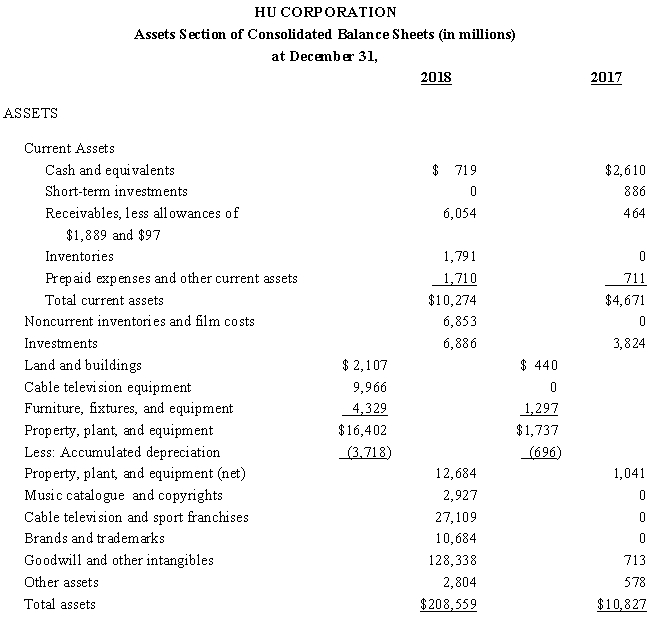

Use the following Assets section of Hu Corporation's balance sheets for the years ended December 31,2018 and 2017 to answer the questions that follow.

Hu Corporation recorded depreciation expense of $344 million for 2017.

Hu Corporation recorded depreciation expense of $344 million for 2017.

-Refer to the information for Hu Corporation.

Required

(1)Explain the impact on net income and cash flows of Hu using straight-line depreciation for financial reporting and accelerated depreciation methods for income tax purposes.

(2)In the notes to the financial statements,Hu indicates that it uses different depreciation methods for different types of plant and equipment assets.Explain why Hu might follow this policy.

Correct Answer:

Verified

(1)Accelerated depreciation allows a com...View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Correct Answer:

Verified

View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Q9: If a company constructs an asset over

Q10: Royal Company purchased a dump truck at

Q11: Biglersville Corp.purchased equipment at the beginning of

Q12: Fulsom Co.began construction of a new factory

Q13: If a company is concerned about minimizing

Q15: Harkin Company purchased a building on a

Q16: On January 1, 2017, Grove City Corp.

Q17: A machine with a cost of $100,000

Q18: Below are several accounts and balances

Q19: Depreciation is a process by which<br>A)replacement funds