Marcus Roberts Operates a Small Retail Establishment Determine the Effect on the Accounting Equation of the Adjusting

Essay

Marcus Roberts operates a small retail establishment.The following unadjusted amounts were taken from Roberts' accounting records at December 31,2017:

?

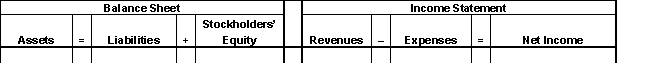

Determine the effect on the accounting equation of the adjusting entries at December 31,2017,for each of the transactions that follow:

?

A. The advertising costs are for television commercials to be aired equally throughout December 2017 and January and February 2018. ?

B. The machinery had an original cost of and was purchased during 2016 . The estimated useful life is six years with an estimated salvage value equal to . Roberts uses the straight-line method of depreciation. ?

Correct Answer:

Verified

Correct Answer:

Verified

Q161: Jenning Co.<br>Jenning Co.adjusts its books each

Q162: A company forgot to record four adjustments

Q163: Windstar Corp.purchased supplies at a cost of

Q164: For each of the following sentences

Q165: Lucky Company purchased a truck at a

Q167: On October 1, 2017, Winter Corp. buys

Q168: Every adjustment involves at least one income

Q169: Ramos Corporation employs 14 workers in its

Q170: Scenic View Foods Corporation<br>The following consolidated statements

Q171: On January 1,2017,ABC,Inc.purchased a copier for