Multiple Choice

Use the following information to answer the question(s) below.

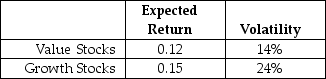

Suppose that all stocks can be grouped into two mutually exclusive portfolios (with each stock appearing in only one portfolio) : growth stocks and value stocks.Assume that these two portfolios are equal in size (market value) ,the correlation of their returns is equal to 0.6,and the portfolios have the following characteristics:  The risk free rate is 3.5%.

The risk free rate is 3.5%.

-Which of the following statements is FALSE?

A) A combination of portfolios on the efficient frontier of risky investments is also on the efficient frontier of risky investments.

B) The conclusion of the CAPM that investors should hold the market portfolio combined with the risk-free investment depends on the quality of an investor's information.

C) The SML holds with some rate r* between rs and rb in place of rf,where r* depends on the proportion of savers and borrowers in the economy.

D) In reality,investors have different information and spend varying amounts of effort on research for assorted stocks.

Correct Answer:

Verified

Correct Answer:

Verified

Q15: Use the information for the question(s)below.<br>Suppose that

Q31: Which of the following statements is FALSE?<br>A)While

Q44: Use the following information to answer the

Q77: Which of the following statements is FALSE?<br>A)The

Q87: Use the following information to answer the

Q113: Use the information for the question(s)below.<br>You are

Q116: Use the information for the question(s)below.<br>Tom's portfolio

Q119: Use the information for the question(s)below.<br>Suppose that

Q121: Use the information for the question(s)below.<br>You are

Q122: Use the table for the question(s)below.<br>Consider the