Essay

The accounting records of Marcus Service Company include the following selected,unadjusted balances at June 30: Accounts Receivable,$2,700; Office Supplies,$1,800; Prepaid Rent,$3,600; Equipment,$15,000; Accumulated Depreciation - Equipment,$1,800; Salaries Payable,$0; Unearned Revenue,$2,400; Office Supplies Expense,$2,800; Rent Expense,$0; Salaries Expense,$15,000; Service Revenue,$40,500.

The following data developed for adjusting entries are as follows:

a.Service revenue accrued,$1,400

b.Unearned Revenue that has been earned,$800

c.Office Supplies on hand,$700

d.Salaries owed to employees,$1,800

e.One month of prepaid rent has expired,$1,200

f.Depreciation on equipment,$1,500

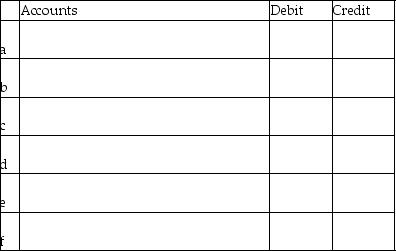

Journalize the adjusting entries.Omit explanations.

Correct Answer:

Verified

\[\begin{array} { | l|l | r | r | }

\hl...View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Correct Answer:

Verified

\hl...

View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Q48: The entry to record depreciation includes a

Q69: If a company fails to make an

Q80: The entry to record depreciation includes a

Q90: The accountant of Skyscrapers Architectural Services failed

Q92: During the accounting period,office supplies were purchased

Q95: The asset account,Office Supplies,had a beginning balance

Q100: On January 1,Unearned Revenue of Grossman,Inc.had a

Q122: List and briefly discuss three accounting concepts

Q133: The matching principle is also called the

Q149: The accountant of Zeus Legal Services failed