Essay

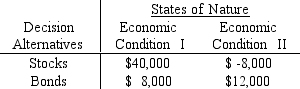

Assume you have a sum of money available which you would like to invest in one of the two available investment plans: Stocks or bonds. The conditional payoffs of each plan under two possible economic conditions are as follows:

a.If the probability of Economic Condition I occurring is 0.8, where should you invest your money? Use the expected value criterion and show your complete work.

b.Compute the expected value of perfect information (EVPI).

c.What kind of probabilities of Economic Conditions I and II should there be before you would be indifferent between investing in stocks and bonds? (i.e., compute the probabilities for which you will be indifferent between investing in stocks or bonds.)

Correct Answer:

Verified

Correct Answer:

Verified

Q1: Exhibit 20-5<br>Below you are given a payoff

Q2: Information about a state of nature is

Q5: Exhibit 20-2<br>Below you are given a payoff

Q6: Super Cola is considering the introduction of

Q7: A maintenance department replaces a malfunctioning machine

Q8: When working backward through a decision tree,

Q8: Assume you are faced with the following

Q44: The probability of one event given the

Q55: A graphic presentation of the expected gain

Q64: A tabular presentation of the expected gain