Short Answer

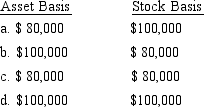

Trolette contributes property with an adjusted basis of $80,000 and a fair market value of $100,000 to a newly formed business entity. If the entity is a C corporation and the transaction qualifies under § 351, the corporation's basis for the property and the shareholder's basis for the stock are:

E) None of the above.

Correct Answer:

Verified

Correct Answer:

Verified

Q25: Fred and Ella are going to establish

Q26: Bev and Cabel each own one-half of

Q61: Arthur is the sole shareholder of Purple,

Q64: Meg has an adjusted basis of $150,000

Q67: Ralph wants to purchase either the stock

Q68: What special adjustment is required in calculating

Q70: For a limited liability company with 100

Q71: Mr. and Ms. Smith's partnership owns the

Q87: The ACE adjustment associated with the C

Q94: Aubrey has been operating his business as