Short Answer

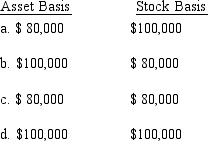

Alanna contributes property with an adjusted basis of $80,000 and a fair market value of $100,000 to a newly formed business entity. If the entity is a partnership and the transaction qualifies under § 721, the partnership's basis for the property and the partner's basis for the partnership interest are:

E) None of the above.

Correct Answer:

Verified

Correct Answer:

Verified

Q12: Each of the following can pass profits

Q15: The profits of a business owned by

Q48: The AMT tax rate for a C

Q50: Melinda's basis for her partnership interest is

Q65: How can double taxation be avoided or

Q80: Match the following attributes with the different

Q99: Which of the following statements is incorrect?<br>A)

Q100: Which of the following is descriptive of

Q102: Albert and Elva each own 50% of

Q140: Match each of the following statements with