Short Answer

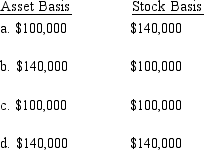

Martin contributes property with an adjusted basis of $100,000 and a fair market value of $140,000 to a newly formed business entity. If the entity is an S corporation and the transaction qualifies under § 351, the S corporation's basis for the property and the shareholder's basis for the stock are:

E) None of the above.

Correct Answer:

Verified

Correct Answer:

Verified

Q18: When compared to a partnership, what additional

Q28: Match the following statements.<br>-Net capital loss<br>A)For the

Q38: To the extent of built-in gain or

Q72: What tax rates apply for the AMT

Q116: Techniques are available that may permit a

Q126: Khalid contributes land (fair market value of

Q126: A limited liability company:<br>A) Is normally subject

Q127: In the sale of a partnership, does

Q129: Which of the following statements is incorrect?<br>A)

Q133: Melba contributes land (basis of $190,000; fair