Multiple Choice

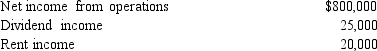

Catfish, Inc., a closely held corporation which is not a PSC, owns a 45% interest in Trout Partnership, which is classified as a passive activity. Trout's taxable loss for the current year is $250,000. During the year, Catfish receives a $60,000 cash distribution from Trout. Other relevant data for Catfish are as follows:  How much of Catfish's share of Trout's loss may it deduct in calculating its taxable income?

How much of Catfish's share of Trout's loss may it deduct in calculating its taxable income?

A) $0

B) $20,000

C) $45,000

D) $112,500

E) None of the above

Correct Answer:

Verified

Correct Answer:

Verified

Q13: From the viewpoint of the entity and

Q19: To which of the following entities does

Q55: A limited liability company (LLC) cannot elect

Q63: Amber, Inc., has taxable income of $212,000.

Q81: Wally contributes land (adjusted basis of $30,000;

Q85: If lease rental payments to a noncorporate

Q98: Malcomb and Sandra (shareholders) each loan Crow

Q140: Match each of the following statements with

Q147: Lisa is considering investing $60,000 in a

Q150: Which of the following special allocations are