Multiple Choice

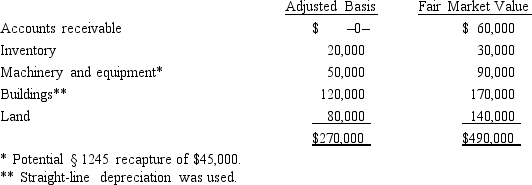

Kristine owns all of the stock of a C corporation which owns the following assets:  Her adjusted basis for her stock is $270,000. Calculate Kristine's recognized gain or loss and classify it as capital or ordinary if she sells her stock for $500,000.

Her adjusted basis for her stock is $270,000. Calculate Kristine's recognized gain or loss and classify it as capital or ordinary if she sells her stock for $500,000.

A) $230,000 ordinary income.

B) $230,000 capital gain.

C) $115,000 ordinary income and $115,000 capital gain.

D) $110,000 ordinary income and $120,000 capital gain.

E) None of the above.

Correct Answer:

Verified

Correct Answer:

Verified

Q31: Tonya contributes $150,000 to Swan, Inc., for

Q32: Barb and Chuck each own one-half of

Q34: Match the following statements:<br>a. Usually subject to

Q37: Marsha is going to contribute the following

Q38: Match the following statements.<br>-Sale of corporate stock

Q42: Match the following statements.<br>-Sale of corporate stock

Q56: Match the following statements.<br>-Technique for minimizing double

Q61: With respect to special allocations, is the

Q112: Swallow, Inc., is going to make a

Q125: Pelican, Inc., a C corporation, distributes $275,000