Essay

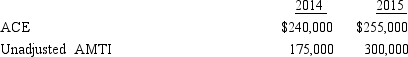

Duck, Inc., is a C corporation that is not eligible for the small business exception to the AMT. Its adjusted current earnings (ACE) and unadjusted alternative minimum taxable income (unadjusted AMTI) for 2014 and 2015 are as follows:

Calculate the amount of the ACE adjustment for 2014 and 2015.

Calculate the amount of the ACE adjustment for 2014 and 2015.

Correct Answer:

Verified

For 2014, there is a positive ACE adjust...View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Correct Answer:

Verified

View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Q11: An S corporation election for Federal income

Q25: Fred and Ella are going to establish

Q26: Bev and Cabel each own one-half of

Q39: John wants to buy a business whose

Q54: Kirby, the sole shareholder of Falcon, Inc.,

Q55: Wren, Inc. is owned by Alfred (30%)

Q64: Meg has an adjusted basis of $150,000

Q69: A limited liability company LLC) is a

Q81: Match the following attributes with the different

Q87: The ACE adjustment associated with the C