Essay

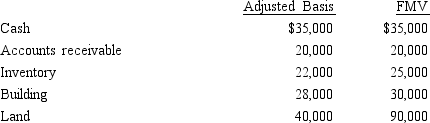

Lee owns all the stock of Vireo, Inc., a C corporation for which he has an adjusted basis of $150,000. The assets of Vireo, Inc., are as follows:

Lee sells his stock to Katrina for $300,000.

Lee sells his stock to Katrina for $300,000.

a. Determine the tax consequences to Lee.

b. Determine the tax consequences to Katrina.

c. Determine the tax consequences to Vireo, Inc.

Correct Answer:

Verified

a. Lee has a recognized gain of $150,000...View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Correct Answer:

Verified

View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Q3: A limited partnership can indirectly avoid unlimited

Q22: Bev and Cabel each have 50% ownership

Q27: Devon owns 40% of the Agate Company

Q29: C corporations and their shareholders are subject

Q31: Tonya contributes $150,000 to Swan, Inc., for

Q56: Match the following statements.<br>-Technique for minimizing double

Q75: A business entity has appreciated land basis

Q77: Which of the following are "reasonable needs"

Q100: Cory is going to purchase the assets

Q125: Pelican, Inc., a C corporation, distributes $275,000