Multiple Choice

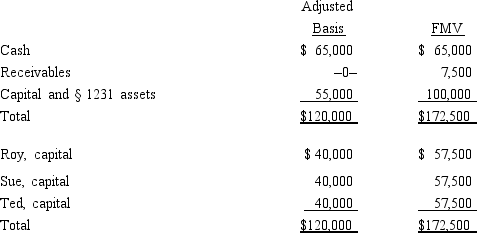

The December 31, 2014, balance sheet of the RST General Partnership reads as follows.  The partners share equally in partnership capital, income, gain, loss, deduction and credit. Ted's adjusted basis for his partnership interest is $40,000. On December 31, 2014, he retires from the partnership, receiving a $60,000 cash payment in liquidation of his interest. The partnership agreement states that $2,500 of the payment is for goodwill. Which of the following statements about this distribution is false?

The partners share equally in partnership capital, income, gain, loss, deduction and credit. Ted's adjusted basis for his partnership interest is $40,000. On December 31, 2014, he retires from the partnership, receiving a $60,000 cash payment in liquidation of his interest. The partnership agreement states that $2,500 of the payment is for goodwill. Which of the following statements about this distribution is false?

A) If capital is NOT a material incomeproducing factor to the partnership, the § 736(a) payment will be $2,500.

B) If capital IS a material incomeproducing factor, the entire $60,000 payment will be a § 736(b) property payment.

C) The payment for Ted's share of goodwill will create $2,500 of ordinary income to him.

D) The partnership can deduct any amount that is a § 736(a) payment because it will be determined without regard to partnership profits.

E) All statements are false.

Correct Answer:

Verified

Correct Answer:

Verified

Q1: Last year, Miguel contributed nondepreciable property with

Q27: In a proportionate liquidating distribution, Sara receives

Q61: Match the following independent descriptions as hot

Q70: Which of the following transactions will not

Q91: Which of the following statements about the

Q93: Match the following statements with the best

Q115: Susan is a one-fourth limited partner in

Q117: Loss cannot be recognized on a distribution

Q127: Match the following statements with the best

Q144: Match the following statements with the best