Multiple Choice

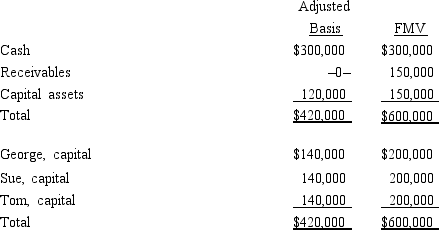

The December 31, 2014, balance sheet of GST Services, LLP reads as follows:  The partners share equally in partnership capital, income, gain, loss, deduction, and credit. Capital is not a material income-producing factor to the partnership, and all partners are active in the business. On December 31, 2014, general partner Sue receives a distribution of $200,000 cash in liquidation of her partnership interest under § 736. Sue's outside basis for the partnership interest immediately before the distribution is $150,000. (Her basis does not correspond to her capital account because she purchased the interest a few years ago at a $10,000 premium.) How much is Sue's gain or loss on the distribution and what is its character?

The partners share equally in partnership capital, income, gain, loss, deduction, and credit. Capital is not a material income-producing factor to the partnership, and all partners are active in the business. On December 31, 2014, general partner Sue receives a distribution of $200,000 cash in liquidation of her partnership interest under § 736. Sue's outside basis for the partnership interest immediately before the distribution is $150,000. (Her basis does not correspond to her capital account because she purchased the interest a few years ago at a $10,000 premium.) How much is Sue's gain or loss on the distribution and what is its character?

A) $50,000 ordinary income.

B) $40,000 ordinary income; $10,000 capital gain.

C) $40,000 capital gain; $10,000 ordinary income.

D) $50,000 capital gain.

E) None of the above.

Correct Answer:

Verified

Correct Answer:

Verified

Q1: A gain will only arise on a

Q11: Frank receives a proportionate nonliquidating distribution from

Q22: At the beginning of the year, Elsie's

Q27: Match the following statements with the best

Q31: Serena owns a 40% interest in the

Q32: Match the following statements with the best

Q40: Match the following independent distribution payments in

Q73: Tom, Tina, Tatum, and Terry are equal

Q106: Match the following independent descriptions as hot

Q175: For Federal income tax purposes, a distribution