Multiple Choice

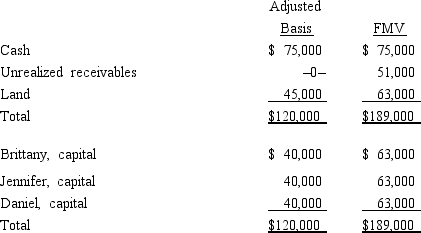

Brittany, Jennifer, and Daniel are equal partners in the BJD Partnership. The partnership balance sheet reads as follows on December 31 of the current year.  Partner Daniel has an adjusted basis of $40,000 for his partnership interest. If Daniel sells his entire partnership interest to new partner Amber for $73,000 cash, how much can the partnership stepup the basis of Amber's share of partnership assets under §§ 754 and 743(b) ?

Partner Daniel has an adjusted basis of $40,000 for his partnership interest. If Daniel sells his entire partnership interest to new partner Amber for $73,000 cash, how much can the partnership stepup the basis of Amber's share of partnership assets under §§ 754 and 743(b) ?

A) $6,000

B) $17,000

C) $23,000

D) $33,000

E) None of the above

Correct Answer:

Verified

Correct Answer:

Verified

Q21: On August 31 of the current tax

Q27: In a proportionate liquidating distribution, Sara receives

Q52: In a proportionate liquidating distribution in which

Q70: Which of the following transactions will not

Q91: Which of the following statements about the

Q93: Match the following statements with the best

Q98: A partnership continues in existence unless one

Q108: Match each of the following statements with

Q135: A cash distribution from a partnership to

Q144: Match the following statements with the best