Multiple Choice

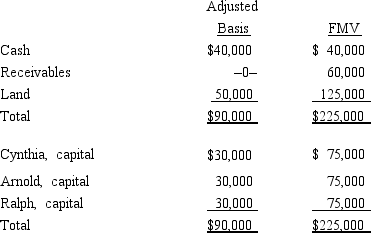

Cynthia sells her 1/3 interest in the CAR Partnership to Brandon for $95,000 cash. On the date of sale, the partnership balance sheet and agreed-upon fair market values were as follows:  If the partnership has a § 754 election in effect, the total "stepup" in basis of partnership assets that will be allocated to Brandon is:

If the partnership has a § 754 election in effect, the total "stepup" in basis of partnership assets that will be allocated to Brandon is:

A) $75,000.

B) $65,000.

C) $45,000.

D) $20,000.

E) $0.

Correct Answer:

Verified

Correct Answer:

Verified

Q17: In a proportionate nonliquidating distribution of cash

Q25: A § 754 election is made for

Q94: Megan's basis was $120,000 in the MYP

Q99: Marcie is a 40% member of the

Q116: Beth sells her 25% partnership interest to

Q122: The RST Partnership makes a proportionate distribution

Q147: Match the following independent descriptions as hot

Q151: Catherine's basis was $50,000 in the CAR

Q161: Landis received $90,000 cash and a capital

Q209: A distribution can be "proportionate" (as defined