Essay

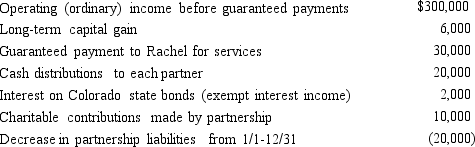

An examination of the RB Partnership's tax books provides the following information for the current year:

Rachel is a 30% general partner in partnership capital, profits, and losses. Assume the adjusted basis of her partnership interest is $60,000 at the beginning of the year, and she shares in 30% of the partnership's liabilities for basis purposes.

Rachel is a 30% general partner in partnership capital, profits, and losses. Assume the adjusted basis of her partnership interest is $60,000 at the beginning of the year, and she shares in 30% of the partnership's liabilities for basis purposes.

a. What is Rachel's adjusted basis for the partnership interest at the end of the year?

b. How much income must Rachel report on her tax return for the current year? What is the character of the income and what types of tax might apply to it?

Correct Answer:

Verified

g. Rachel's adjusted basis for her partn...View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Correct Answer:

Verified

View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Q5: In which of the following independent situations

Q12: In the current year, Derek formed an

Q31: Sharon contributed property to the newly formed

Q35: Match each of the following statements with

Q39: Alicia and Barry form the AB Partnership

Q64: Seven years ago, Paul purchased residential rental

Q91: A partnership's allocations of income and deductions

Q138: Match each of the following statements with

Q169: Match each of the following statements with

Q221: Match each of the following statements with