Essay

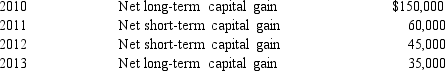

Carrot Corporation, a C corporation, has a net short-term capital gain of $65,000 and a net long-term capital loss of $250,000 during 2014. Carrot Corporation had taxable income from other sources of $720,000. Prior years' transactions included the following:

Compute the amount of Carrot's capital loss carryover to 2015.

Compute the amount of Carrot's capital loss carryover to 2015.

a. $0

b. $32,000

c. $45,000

d. $185,000

e. None of the above

Correct Answer:

Verified

Correct Answer:

Verified

Q10: Saleh, an accountant, is the sole shareholder

Q11: Heron Corporation, a calendar year, accrual basis

Q12: Beige Corporation, a C corporation, purchases a

Q15: On December 31, 2014, Peregrine Corporation, an

Q16: Jake,the sole shareholder of Peach Corporation,a C

Q17: Hornbill Corporation, a cash basis and calendar

Q23: Quail Corporation is a C corporation with

Q64: Azure Corporation, a C corporation, had a

Q69: In the current year, Sunset Corporation (a

Q128: Adrian is the president and sole shareholder