Essay

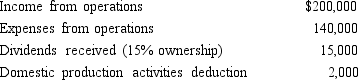

During the current year, Kingbird Corporation (a calendar year C corporation) had the following income and expenses:

On October 1, Kingbird Corporation made a contribution to a qualified charitable organization of $9,000 in cash (not included in any of the above items). Determine Kingbird's charitable contribution deduction for the current year.

On October 1, Kingbird Corporation made a contribution to a qualified charitable organization of $9,000 in cash (not included in any of the above items). Determine Kingbird's charitable contribution deduction for the current year.

a. $9,000

b. $7,500

c. $6,650

d. $6,450

e. None of the above

Correct Answer:

Verified

Correct Answer:

Verified

Q6: The passive loss rules apply to closely

Q7: Lilac Corporation incurred $4,700 of legal and

Q21: Double taxation of corporate income results because

Q41: Don, the sole shareholder of Pastel Corporation

Q51: Which of the following statements is incorrect

Q52: In 2014, Bluebird Corporation had net income

Q58: What is the annual required estimated tax

Q67: Pablo,a sole proprietor,sold stock held as an

Q107: In the current year,Crimson,Inc.,a calendar C corporation,has

Q108: Income that is included in net income