Essay

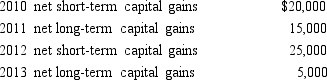

Ostrich, a C corporation, has a net short-term capital gain of $20,000 and a net long-term capital loss of $90,000 during 2014. Ostrich also has taxable income from other sources of $1 million. Prior years' transactions included the following:

a. How are the capital gains and losses treated on Ostrich's 2014 tax return?

b. Determine the amount of the 2014 net capital loss that is carried back to each of the previous years.

c. Compute the amount of capital loss carryover, if any, and indicate the years to which the loss may be carried.

d. If Ostrich were a proprietorship, how would Ellen, the owner, report these transactions on her 2014 tax return?

Correct Answer:

Verified

a. Net short-term capital gain $ 20,000

...View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Correct Answer:

Verified

...

View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Q9: Crow Corporation, a C corporation, donated scientific

Q26: On December 31, 2014, Flamingo, Inc., a

Q27: Briefly describe the accounting methods available for

Q29: Bjorn owns a 60% interest in an

Q32: Ivory Corporation, a calendar year, accrual method

Q32: The corporate marginal income tax rates range

Q33: Juanita owns 60% of the stock in

Q35: Heron Corporation, a calendar year C corporation,

Q37: A corporate net operating loss can be

Q96: During the current year, Sparrow Corporation, a