Essay

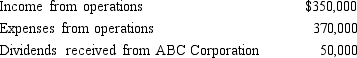

During the current year, Quartz Corporation (a calendar year C corporation) has the following transactions:

Quartz owns 25% of ABC Corporation's stock. How much is Quartz Corporation's taxable income (loss) for the year?

Quartz owns 25% of ABC Corporation's stock. How much is Quartz Corporation's taxable income (loss) for the year?

Correct Answer:

Verified

Quartz has an NOL, computed as shown bel...View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Correct Answer:

Verified

View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Q15: Briefly discuss the requirements for the dividends

Q25: For purposes of the estimated tax payment

Q31: Orange Corporation owns stock in White Corporation

Q33: Flycatcher Corporation,a C corporation,has two equal individual

Q54: Schedule M-1 of Form 1120 is used

Q64: Schedule M-1 of Form 1120 is used

Q79: Grebe Corporation, a closely held corporation that

Q105: Gerald, a cash basis taxpayer, owns 70%

Q107: During the current year, Maroon Company had

Q110: Schedule M-2 is used to reconcile unappropriated