Essay

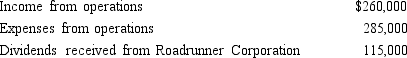

During the current year, Coyote Corporation (a calendar year C corporation) has the following transactions:

a. Coyote owns 5% of Roadrunner Corporation's stock. How much is Coyote Corporation's taxable income (loss) for the year?

b. Would your answer change if Coyote owned 25% of Roadrunner Corporation's stock?

Correct Answer:

Verified

p. The key to this question is the relat...View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Correct Answer:

Verified

View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Q12: Contrast the tax treatment of capital gains

Q66: Canary Corporation, an accrual method C corporation,

Q70: Tonya, an actuary, is the sole shareholder

Q74: Warbler Corporation, an accrual method regular corporation,

Q75: During the current year, Owl Corporation (a

Q77: A calendar year C corporation can receive

Q80: What is the purpose of Schedule M-3?

Q89: In the current year,Oriole Corporation donated a

Q115: Albatross, a C corporation, had $140,000 net

Q116: Because of the taxable income limitation, no