Essay

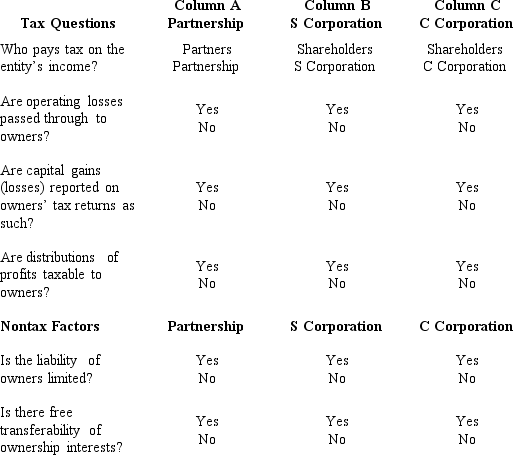

Compare the basic tax and nontax factors of doing business as a partnership, an S corporation, and a C corporation. Circle the correct answers.

Correct Answer:

Verified

Correct Answer:

Verified

Related Questions

Q4: Robin Corporation, a calendar year C corporation,

Q7: Patrick, an attorney, is the sole shareholder

Q10: Saleh, an accountant, is the sole shareholder

Q11: Heron Corporation, a calendar year, accrual basis

Q16: Jake,the sole shareholder of Peach Corporation,a C

Q58: Which of the following statements is correct

Q69: In the current year, Sunset Corporation (a

Q99: Briefly describe the charitable contribution deduction rules

Q103: A taxpayer is considering the formation of

Q109: Red Corporation,which owns stock in Blue Corporation,had