Multiple Choice

Exhibit 13-1

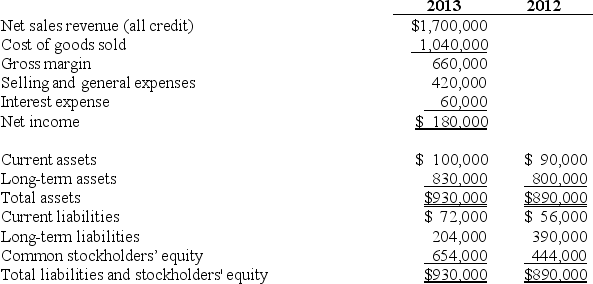

Xavier Company reported the following income statement and balance sheet amounts on December 31,2013.

Inventory and prepaid expenses account for $50,000 of the 2013 current assets.

Inventory and prepaid expenses account for $50,000 of the 2013 current assets.

Average inventory for 2013 is $36,000.

Average net accounts receivable for 2013 is $62,000.

Average one-day sales are $5,900.

There are 12,000 shares of common stock outstanding at the end of 2013.

The market price per share of common stock is $27 at the end of 2013.

The EPS for 2013 is equal to $1.50 per share.

-Refer to Exhibit 13-1.What is the profit margin ratio for 2013 (rounded to the nearest tenth of a percent) ?

A) 10.6%

B) 1.1%

C) 27.3%

D) 38.8%

E) None of the answer choices is correct.

Correct Answer:

Verified

Correct Answer:

Verified

Q1: Albany Company has net income before taxes

Q6: Dresden Inc.has net sales of $1,200,000,cost of

Q15: The price-earnings ratio measures the premium investors

Q16: Times interest earned indicates the company's ability

Q17: A current ratio of greater than 1.0

Q24: If a company's return on assets is

Q31: Return on assets is a market valuation

Q41: Which of the following types of companies

Q51: The quick ratio is a short-term liquidity

Q55: Exhibit 13-1<br>Xavier Company reported the following income