Essay

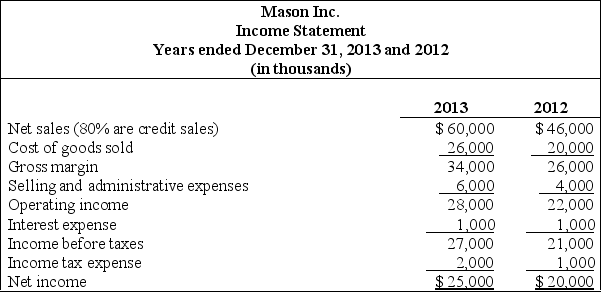

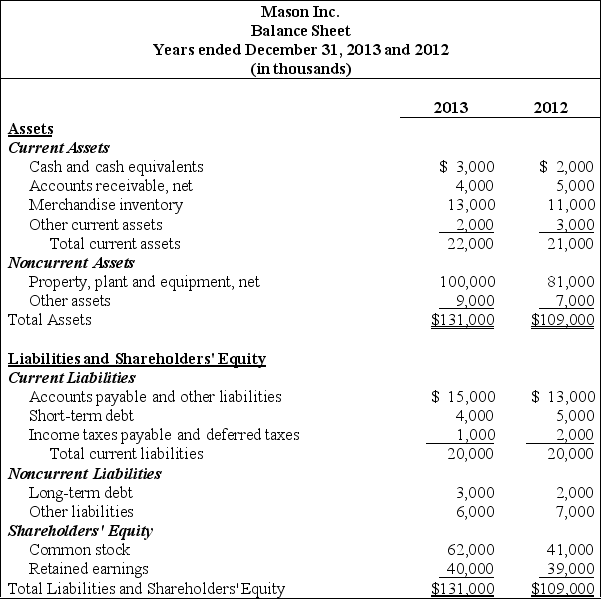

The following condensed income statement is for Mason Inc.

Compute the following ratios for 2013,and provide a brief explanation after each ratio (round percentage computations to one decimal place and earnings per share to two decimal places):

(1)Gross margin ratio

(2)Profit margin ratio

(3)Return on assets

(4)Return on common shareholders' equity

(5)Earnings per share (assume weighted average shares outstanding totaled 2,900,000 shares)

(6)Market capitalization (assume 3,000,000 shares were issued and outstanding at December 31,2013,and the market price was $9.00 per share)

(7)Price-earnings ratio

Correct Answer:

Verified

(1)Gross margin ratio 61.7% for every do...View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Correct Answer:

Verified

View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Q3: Which of the following is the best

Q11: If net sales is growing at a

Q13: Belden Company has a profit margin ratio

Q19: Filmore Inc.has the following information available for

Q21: Pilot Company has the following information available

Q22: The following condensed income statement is for

Q23: Exhibit 13-1<br>Xavier Company reported the following income

Q32: Which of the following types of measures

Q35: Assume that Crimson Company's market price per

Q43: On a common-size income statement,net income should