Essay

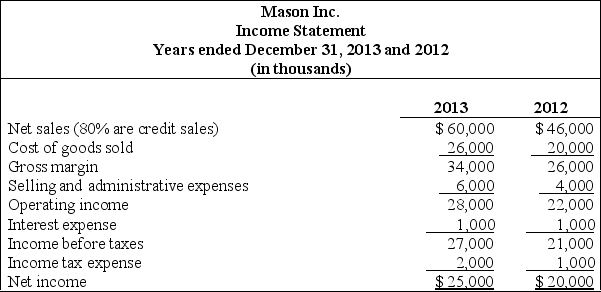

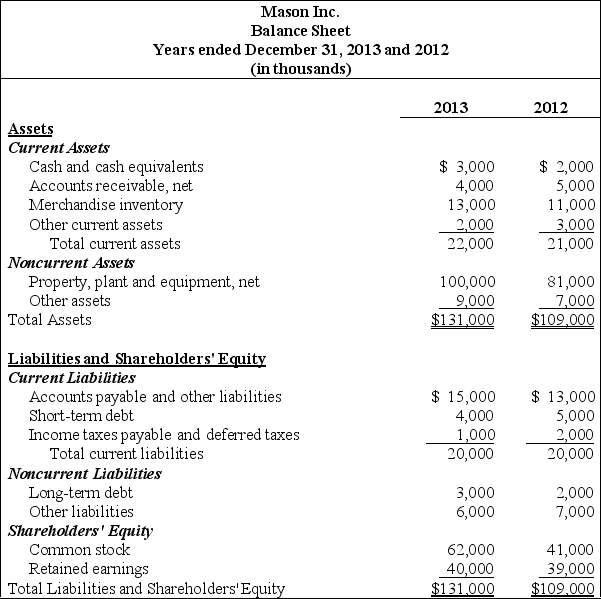

The following condensed income statement is for Mason Inc.

Compute the following ratios for 2013,and provide a brief explanation after each ratio (round computations to two decimal places):

(1)Current ratio

(2)Quick ratio

(3)Receivables turnover ratio

(4)Average collection period

(5)Inventory turnover ratio

(6)Average sale period

Correct Answer:

Verified

(1)Current ratio 1.10 to 1 for every dol...View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Correct Answer:

Verified

View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Q2: All of the following are nonfinancial measures

Q8: Exhibit 13-1<br>Xavier Company reported the following income

Q9: All of the following measures focus on

Q10: The following debt to equity ratio is

Q11: During 2013,Victory Inc.had beginning accounts receivable of

Q12: During 2013,Columbia Inc.had beginning accounts receivable of

Q38: Most public companies present trend information in

Q46: The total assets dollar amount is typically

Q54: All of the following account balances would

Q55: All of the following measures focus on