Multiple Choice

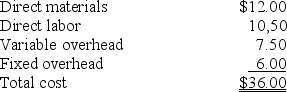

Starline Inc.manufactures and sells commercial coffee makers and coffee grinders.The Coffee Grinder Division incurs the following costs for the production of each coffee grinder when 4,000 coffee grinders are produced each year.

The company sells the coffee grinders to various retail stores for $60.00.The Coffee Maker Division is doing a promotion whereby each customer that purchases a coffee maker will receive a free coffee grinder.The Coffee Maker Division would like to purchase these coffee grinders from the Coffee Grinder Division.

Assuming the Coffee Grinder Division has excess capacity and there would be no lost sales by selling internally,what is the optimal transfer price that should be charged to the Coffee Maker Division?

A) $30.00

B) $22.50

C) $36.00

D) $60.00

E) None of the answer choices is correct.

Correct Answer:

Verified

Correct Answer:

Verified

Q7: Exhibit 11-1<br>Ashville Company has two divisions

Q11: If decisions within a company are made

Q13: When defining operating income for return on

Q17: Return on investment (ROI)can be calculated several

Q21: All of the following are false about

Q26: Exhibit 11-1<br>Ashville Company has two divisions

Q41: Which of the following ratios can managers

Q46: A cost center is an organizational segment

Q57: Exhibit 11-5<br>Sports Products Inc.sells skis and

Q62: An investment center is an organizational segment