Essay

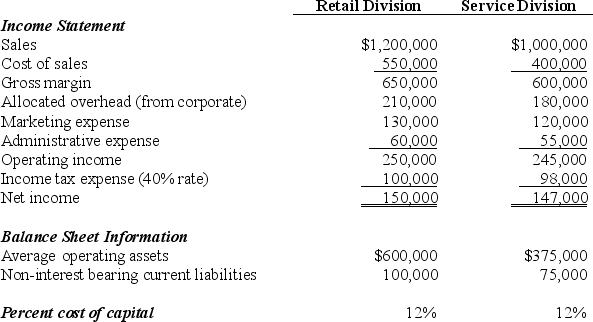

Becky's Bikes Inc.has two divisions: Retail and Service.The following information is for each division at Becky's Bikes for the most recent fiscal year.

To calculate EVA,management requires adjustments for marketing and non-interest bearing current liabilities as outlined below.

Marketing will be capitalized and amortized over several years resulting in an increase to average operating assets of $50,000 for the Retail division and $32,500 for the Services division.On the income statement,marketing expense for the year will be added back to operating income,then marketing amortization expense for one year will be deducted.The current year amortization expense will total $30,000 for the Retail division and $20,000 for the Services division.

Non-interest bearing liabilities will be deducted from average operating assets.

Calculate economic value added (EVA)for each division and comment on your results.

Correct Answer:

Verified

First calculate adjusted net operating p...View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Correct Answer:

Verified

View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Q3: Operating assets would include office buildings leased

Q9: Exhibit 11-4<br>The following information is for

Q12: Residual income is the portion of income

Q14: Residual income is the dollar amount of

Q24: Which of the following best describes an

Q30: Petra Company has the following information available

Q30: Exhibit 11-3<br>Dillon Company has the following

Q44: Exhibit 11-5<br>Sports Products Inc.sells skis and

Q45: Which of the following statements is true

Q61: Exhibit 11-1<br>Ashville Company has two divisions