Multiple Choice

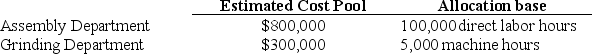

Gabriel Company uses the department approach for allocating overhead.The Assembly Department uses direct labor hours as its allocation base and the Grinding Department uses machine hours as its allocation base.The data for each is as follows:

What is the allocation rate for each Department (round to the nearest cent) ?

A) Assembly = $11.00 per direct labor hour;Grinding = $220.00 per machine hour.

B) Assembly = $0.13 per direct labor hour;Grinding = $0.02 per machine hour.

C) Assembly = $8.00 per direct labor hour;Grinding = $60.00 per machine hour.

D) Assembly = $10.48 per direct labor hour;Grinding = $10.48 per machine hour.

E) None of the answer choices is correct.

Correct Answer:

Verified

Correct Answer:

Verified

Q11: U.S.Generally Accepted Accounting Principles require all manufacturing

Q15: Which of the following statements best describes

Q32: Exhibit 3-3<br>Metro Inc.has two production departments

Q34: Which of the following items is not

Q35: Which of the following shows the steps

Q38: All of the following can be performed

Q44: Organizations that use activity-based costing to allocate

Q51: Kathy Edwards owns a landscape maintenance service

Q57: Exhibit 3-3<br>Metro Inc.has two production departments

Q65: Exhibit 3-3<br>Metro Inc.has two production departments