Multiple Choice

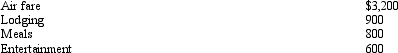

During the year, Walt went from Louisville to Hawaii on business.Preceding a five-day business meeting, he spent four days vacationing at the beach.Excluding the vacation costs, his expenses for the trip are:  Presuming no reimbursement, deductible expenses are:

Presuming no reimbursement, deductible expenses are:

A) $5,500.

B) $4,800.

C) $3,900.

D) $3,200.

E) None of the above.

Correct Answer:

Verified

Correct Answer:

Verified

Q21: Match the statements that relate to each

Q22: Faith just graduated from college and she

Q23: Under the actual cost method, which, if

Q24: In which, if any, of the following

Q27: A participant, who is age 38, in

Q30: A taxpayer who claims the standard deduction

Q72: Amy lives and works in St.Louis.In the

Q77: Ashley and Matthew are husband and wife

Q97: In some cases it may be appropriate

Q156: One indicia of independent contractor (rather than