Multiple Choice

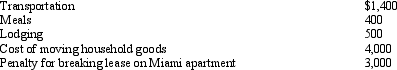

Due to a merger, Allison transfers from Miami to Chicago.Under a new job description, she is reclassified from employee to independent contractor status.Her moving expenses, which are not reimbursed, are as follows:  Allison's deductible moving expense is:

Allison's deductible moving expense is:

A) $0.

B) $5,900.

C) $6,100.

D) $8,900.

E) $9,300.

Correct Answer:

Verified

Correct Answer:

Verified

Related Questions

Q31: If a taxpayer does not own a

Q67: For the spousal IRA provision to apply,

Q71: Madison is an instructor of fine arts

Q130: Alexis (a CPA and JD) sold her

Q131: The § 222 deduction for tuition and

Q134: A taxpayer who claims the standard deduction

Q137: Samuel, age 53, has a traditional deductible

Q138: Rod uses his automobile for both business

Q139: Ramon and Ingrid work in the field

Q158: At age 65, Camilla retires from her