Multiple Choice

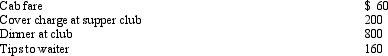

Henry entertains several of his key clients on January 1 of the current year.Expenses paid by Henry are as follows:  Presuming proper substantiation, Henry's deduction is:

Presuming proper substantiation, Henry's deduction is:

A) $1,220.

B) $740.

C) $640.

D) $610.

E) None of the above.

Correct Answer:

Verified

Correct Answer:

Verified

Related Questions

Q14: Ava holds two jobs and attends graduate

Q15: Regarding § 222 (qualified higher education deduction

Q17: Corey performs services for Sophie. Which, if

Q21: Match the statements that relate to each

Q22: Faith just graduated from college and she

Q23: Under the actual cost method, which, if

Q63: Contributions to a Roth IRA can be

Q70: After graduating from college with a degree

Q85: If an individual is ineligible to make

Q89: For tax purposes, travel is a broader