Essay

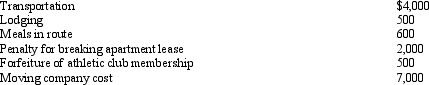

Marcie moved from Oregon to West Virginia to accept a better job.She incurred the following unreimbursed moving expenses:

What is Nicole's moving expense deduction?

What is Nicole's moving expense deduction?

Correct Answer:

Verified

$11,500 ($4,000 + $500 + $7,00...View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Correct Answer:

Verified

$11,500 ($4,000 + $500 + $7,00...

View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Related Questions

Q2: A taxpayer who uses the automatic mileage

Q16: In terms of income tax treatment, what

Q32: Elsie lives and works in Detroit. She

Q81: There is no cutback adjustment for meals

Q109: Kelly, an unemployed architect, moves from Boston

Q119: When using the automatic mileage method, which,

Q121: The Federal per diem rates that can

Q122: In terms of IRS attitude, what do

Q125: Tired of her 60 mile daily commute,

Q127: A worker may prefer to be classified