Essay

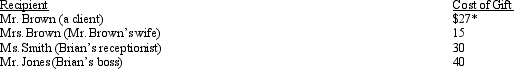

Brian makes gifts as follows:

* Includes $2 for engraving

* Includes $2 for engraving

Presuming adequate substantiation and no reimbursement, how much may Brian deduct?

Correct Answer:

Verified

$52 ($27 + $25).The deduction for Mr.Bro...View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Correct Answer:

Verified

$52 ($27 + $25).The deduction for Mr.Bro...

View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Related Questions

Q17: A taxpayer who maintains an office in

Q114: For self-employed taxpayers, travel expenses are not

Q142: During 2012, Eva used her car as

Q143: Carolyn is single and has a college

Q147: Concerning the deduction for moving expenses, what

Q148: Mallard Corporation furnishes meals at cost to

Q150: A worker may prefer to be treated

Q151: In May 2012, after 11 months on

Q152: A taxpayer just changed jobs and incurred

Q167: For the current football season, Tern Corporation