Essay

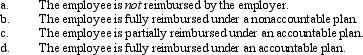

Discuss the 2%-of-AGI floor and the 50% cutback limitation in connection with various employee expenses under the following arrangements:

Correct Answer:

Verified

Correct Answer:

Verified

Related Questions

Q13: In choosing between the actual expense method

Q24: Marvin lives with his family in Alabama.

Q100: The portion of the office in the

Q101: Edna lives and works in Cleveland.She travels

Q103: Which, if any, of the following factors

Q104: Allowing for the cutback adjustment (50% reduction

Q108: Travel status requires that the taxpayer be

Q109: Janet, who lives and works in Newark,

Q110: Which, if any, of the following is

Q161: If the cost of uniforms is deductible,