Multiple Choice

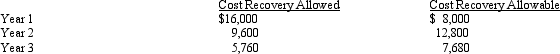

Tara purchased a machine for $40,000 to be used in her business.The cost recovery allowed and allowable for the three years the machine was used are as follows:  If Tara sells the machine after three years for $15,000, how much gain should she recognize?

If Tara sells the machine after three years for $15,000, how much gain should she recognize?

A) $3,480.

B) $6,360.

C) $9,240.

D) $11,480.

E) None of the above.

Correct Answer:

Verified

Correct Answer:

Verified

Q3: The maximum cost recovery method for all

Q79: Bhaskar purchased a new factory building on

Q80: On June 1, 2012, Norm leases a

Q82: The statutory dollar cost recovery limits under

Q83: When lessor owned leasehold improvements are abandoned

Q86: Discuss the criteria used to determine whether

Q87: Nora purchased a new automobile on July

Q89: On July 17, 2012, Kevin places in

Q100: The inclusion amount for a leased automobile

Q101: Taxable income for purposes of § 179