Essay

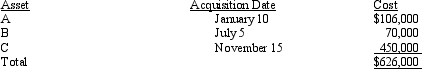

Audra acquires the following new five-year class property in 2012:

Audra elects § 179 for Asset

Audra elects § 179 for Asset

C.Audra's taxable income from her business would not create a limitation for purposes of the § 179 deduction. Audra takes additional first-year depreciation.Determine her total cost recovery deduction (including the § 179 deduction) for the year.

Correct Answer:

Verified

$450,000/$626,000 = ...View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Correct Answer:

Verified

View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Q15: Discuss the difference between the half-year convention

Q41: On February 20, 2012, Susan paid $200,000

Q43: If a taxpayer uses regular MACRS for

Q45: If 150% declining-balance is used, there is

Q48: The cost of a covenant not to

Q49: Diane purchased a factory building on November

Q50: Hans purchased a new passenger automobile on

Q51: On August 20, 2011, May signed a

Q69: Discuss the tax consequences of listed property

Q115: During the past two years, through extensive