Essay

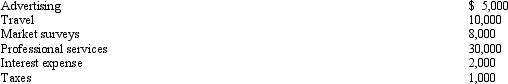

In 2012, Marci is considering starting a new business. Marci had the following costs associated with this venture:

Marci started the new business on October 1, 2012. Determine the deduction for Marci's startup costs for 2012.

Marci started the new business on October 1, 2012. Determine the deduction for Marci's startup costs for 2012.

Correct Answer:

Verified

Correct Answer:

Verified

Related Questions

Q51: On June 1 of the current year,

Q65: Percentage depletion enables the taxpayer to recover

Q66: If an automobile is placed in service

Q67: On June 1, 2012, James places in

Q68: Intangible drilling costs may be expensed rather

Q69: The § 179 deduction can exceed $139,000

Q72: All personal property placed in service in

Q74: Hazel purchased a new business asset (five-year

Q75: If more than 40% of the value

Q79: MACRS depreciation is used to compute earnings