Multiple Choice

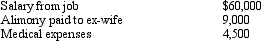

Larry, a calendar year cash basis taxpayer, has the following transactions:  Based on this information, Larry has:

Based on this information, Larry has:

A) AGI of $46,500.

B) AGI of $51,000.

C) AGI of $60,000.

D) Deduction for medical expenses of $0.

E) None of the above.

Correct Answer:

Verified

Correct Answer:

Verified

Related Questions

Q10: Which of the following statements is correct

Q11: The income of a sole proprietorship are

Q12: On January 2, 2012, Fran acquires a

Q13: Priscella pursued a hobby of making bedspreads

Q14: The only § 212 expenses that are

Q14: Beige, Inc., an airline manufacturer, is conducting

Q16: Landscaping expenditures on new rental property are

Q20: Walter sells land with an adjusted basis

Q21: Alice incurs qualified moving expenses of $12,000.

Q132: Because Scott is three months delinquent on