Multiple Choice

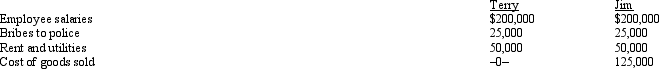

Terry and Jim are both involved in operating illegal businesses.Terry operates a gambling business and Jim operates a drug running business.Both businesses have gross revenues of $500,000.The businesses incur the following expenses.  Which of the following statements is correct?

Which of the following statements is correct?

A) Neither Terry nor Jim can deduct any of the above items in calculating the business profit.

B) Terry should report profit from his business of $250,000.

C) Jim should report profit from his business of $500,000.

D) Jim should report profit from his business of $250,000.

E) None of the above.

Correct Answer:

Verified

Correct Answer:

Verified

Q22: Investigation of a business unrelated to one's

Q45: The cash method can be used even

Q54: If an activity involves horses, a profit

Q63: Max opened his dental practice (a sole

Q64: Marvin spends the following amounts on a

Q65: Mattie and Elmer are separated and are

Q67: Trade and business expenses should be treated

Q69: Iris, a calendar year cash basis taxpayer,

Q71: Al single, age 60, and has gross

Q93: In a related-party transaction where realized loss