Multiple Choice

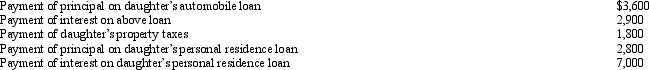

Melba incurred the following expenses for her dependent daughter during the current year:  How much may Melba deduct in computing her itemized deductions?

How much may Melba deduct in computing her itemized deductions?

A) $0.

B) $8,800.

C) $11,700.

D) $18,100.

E) None of the above.

Correct Answer:

Verified

Correct Answer:

Verified

Related Questions

Q36: The portion of property tax on a

Q41: Amos, a shareholder-employee of Pigeon, Inc., receives

Q43: Albie operates an illegal drug-running business and

Q43: Briefly explain why interest on money borrowed

Q46: Sandra owns an insurance agency.The following selected

Q47: Marge sells land to her adult son,

Q48: Which of the following is not a

Q72: All domestic bribes (i.e., to a U.S.official)

Q114: For a vacation home to be classified

Q121: Why are there restrictions on the recognition