Essay

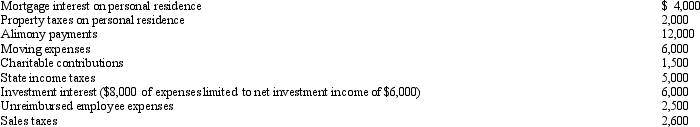

Arnold and Beth file a joint return.Use the following data to calculate their deduction for AGI.

Correct Answer:

Verified

Arnold and Beth's deduction for AGI is $...View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Correct Answer:

Verified

Arnold and Beth's deduction for AGI is $...

View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Related Questions

Q19: Graham, a CPA, has submitted a proposal

Q40: The cost of legal advice associated with

Q51: If a vacation home is determined to

Q52: Which of the following is a deduction

Q53: Bob and April own a house at

Q54: Ralph wants to give his daughter $1,000

Q58: Andrew, who operates a laundry business, incurred

Q59: For an expense to be deducted as

Q78: Generally, a closely held family corporation is

Q151: Which of the following is incorrect?<br>A) Alimony